The Ultimate Guide To Feie Calculator

Wiki Article

What Does Feie Calculator Mean?

Table of ContentsThe 8-Minute Rule for Feie CalculatorWhat Does Feie Calculator Do?The Of Feie CalculatorFeie Calculator Fundamentals ExplainedLittle Known Facts About Feie Calculator.

He offered his U.S. home to develop his intent to live abroad permanently and used for a Mexican residency visa with his other half to help fulfill the Bona Fide Residency Test. Neil aims out that purchasing residential property abroad can be challenging without very first experiencing the location."It's something that people require to be actually thorough concerning," he says, and advises deportees to be careful of usual errors, such as overstaying in the United state

Neil is careful to cautious to Tension tax united state tax obligation "I'm not conducting any business in Organization. The U.S. is one of the couple of countries that tax obligations its people no matter of where they live, implying that even if an expat has no revenue from U.S.

tax returnTax obligation "The Foreign Tax Credit allows people working in high-tax countries like the UK to counter their U.S. tax responsibility by the amount they have actually already paid in tax obligations abroad," claims Lewis.

Excitement About Feie Calculator

Below are some of one of the most regularly asked questions regarding the FEIE and other exemptions The International Earned Income Exemption (FEIE) allows U.S. taxpayers to exclude up to $130,000 of foreign-earned income from federal earnings tax, lowering their U.S. tax responsibility. To receive FEIE, you should fulfill either the Physical Existence Test (330 days abroad) or the Authentic House Examination (confirm your primary residence in an international country for a whole tax year).

The Physical Existence Examination requires you to be outside the U.S. for 330 days within a 12-month period. The Physical Visibility Test additionally requires united state taxpayers to have both a foreign earnings and an international tax obligation home. A tax obligation home is specified as your prime place for service or employment, despite your family's house.

The Facts About Feie Calculator Revealed

An earnings tax obligation treaty in between the united state and an additional country can assist stop double tax. While the Foreign Earned Income Exemption decreases taxed earnings, a treaty might supply fringe benefits for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Record) is a called for declaring for united state people with over $10,000 in foreign financial accounts.Qualification for FEIE depends on meeting details residency or physical click site presence tests. is a tax advisor on the Harness system and the creator of Chessis Tax obligation. He belongs to the National Association of Enrolled Agents, the Texas Society of Enrolled Professionals, and the Texas Society of CPAs. He brings over a years of experience helping Large 4 firms, recommending expatriates and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation advisor on the Harness platform and the owner of The Tax Man. He has over thirty years of experience and now specializes in CFO services, equity compensation, copyright taxation, marijuana taxes and separation associated tax/financial planning matters. He is an expat based in Mexico - https://blogfreely.net/feiecalcu/taxes-for-american-expats-a-complete-survival-guide-with-the-feie-calculator.

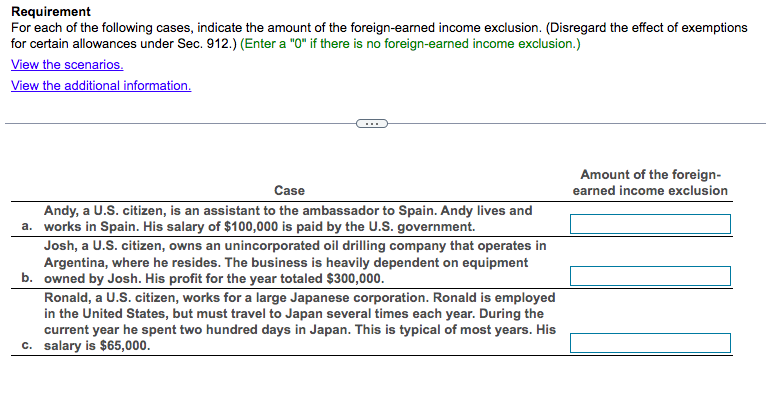

The international made earnings exemptions, often referred to as the Sec. 911 exemptions, leave out tax obligation on earnings gained from working abroad.

Unknown Facts About Feie Calculator

The tax obligation benefit omits the income from tax at lower tax obligation prices. Formerly, the exclusions "came off the top" lowering earnings subject to tax obligation at the top tax obligation prices.These exclusions do not spare the incomes from United States taxes however merely supply a tax obligation reduction. Keep in mind that a solitary individual working abroad for every one of 2025 that made regarding $145,000 with no other earnings will certainly have taxable income lowered to no - effectively the very same response as being "tax obligation totally free." The exclusions are computed every day.

Report this wiki page